GDPR: Early impact to traffic & buyers

GDPR: Early impact to traffic & buyers

How is mobile ad traffic being affected by GDPR?

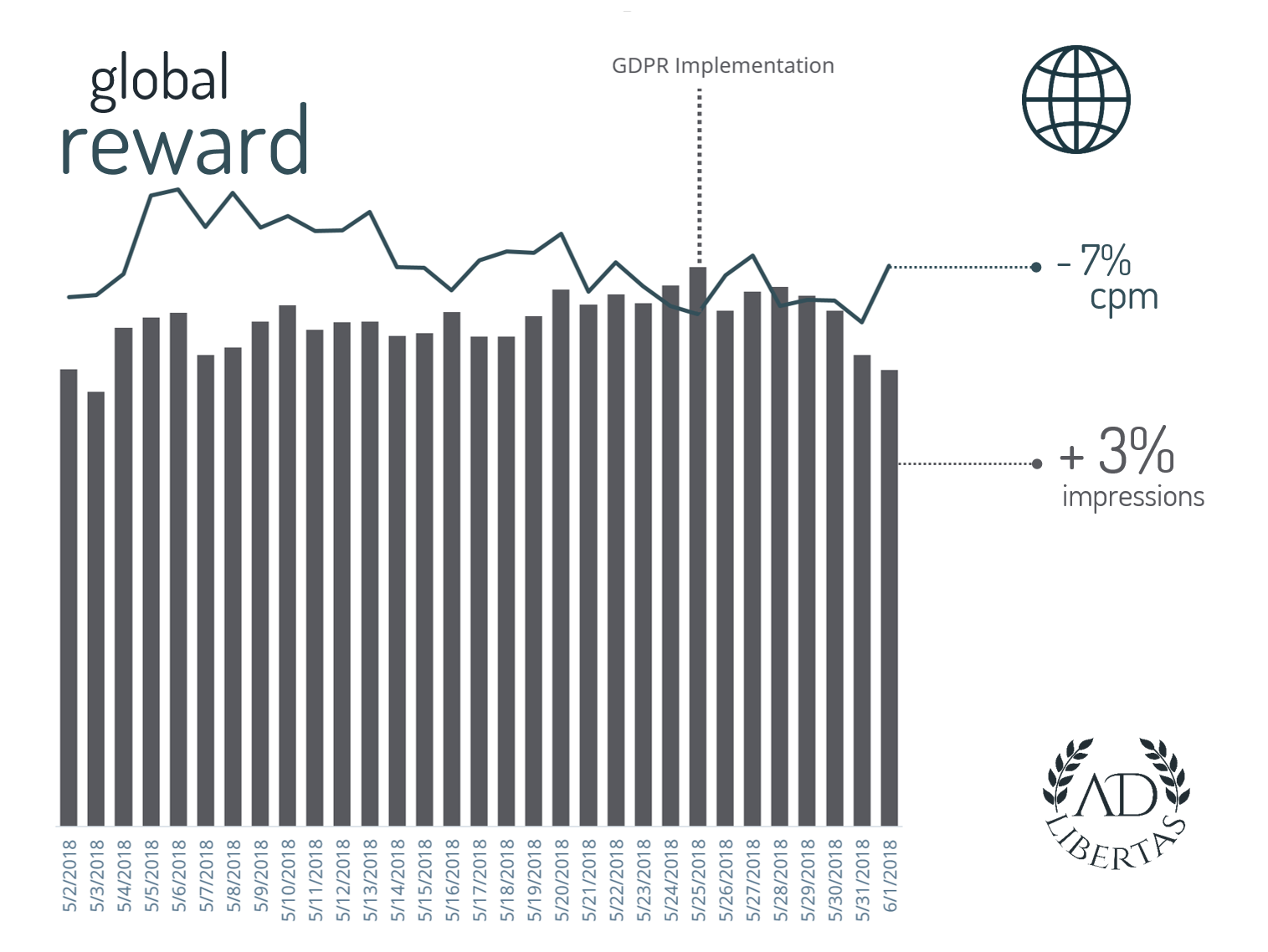

- Surprisingly, despite a large pull back on EEU volume, global impact is very low.

- Banner CPMs most affected (-40% EEU)

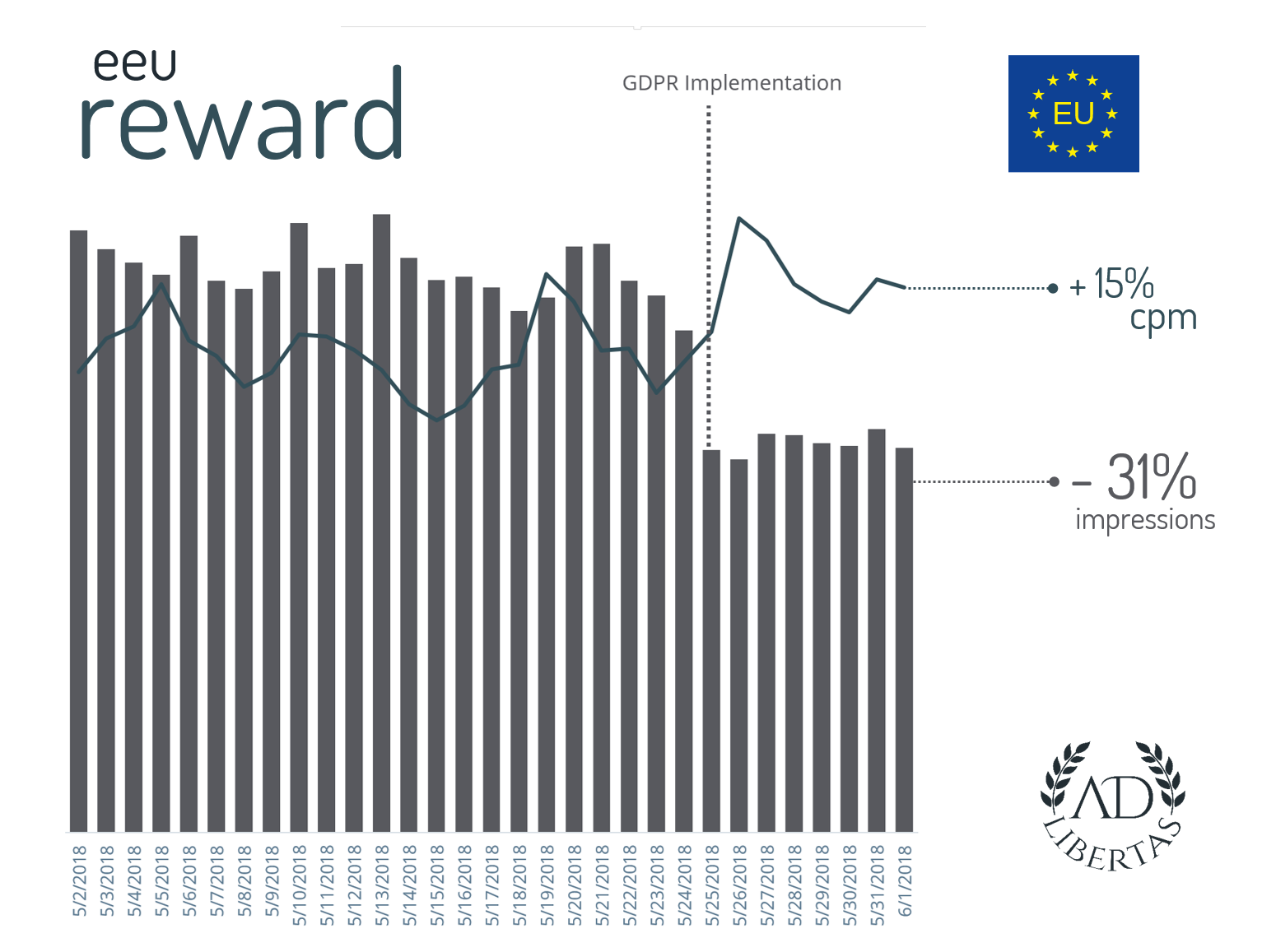

- Shortage of reward video inventory driving up prices.

- Publishers & buyers running tags feeling biggest brunt.

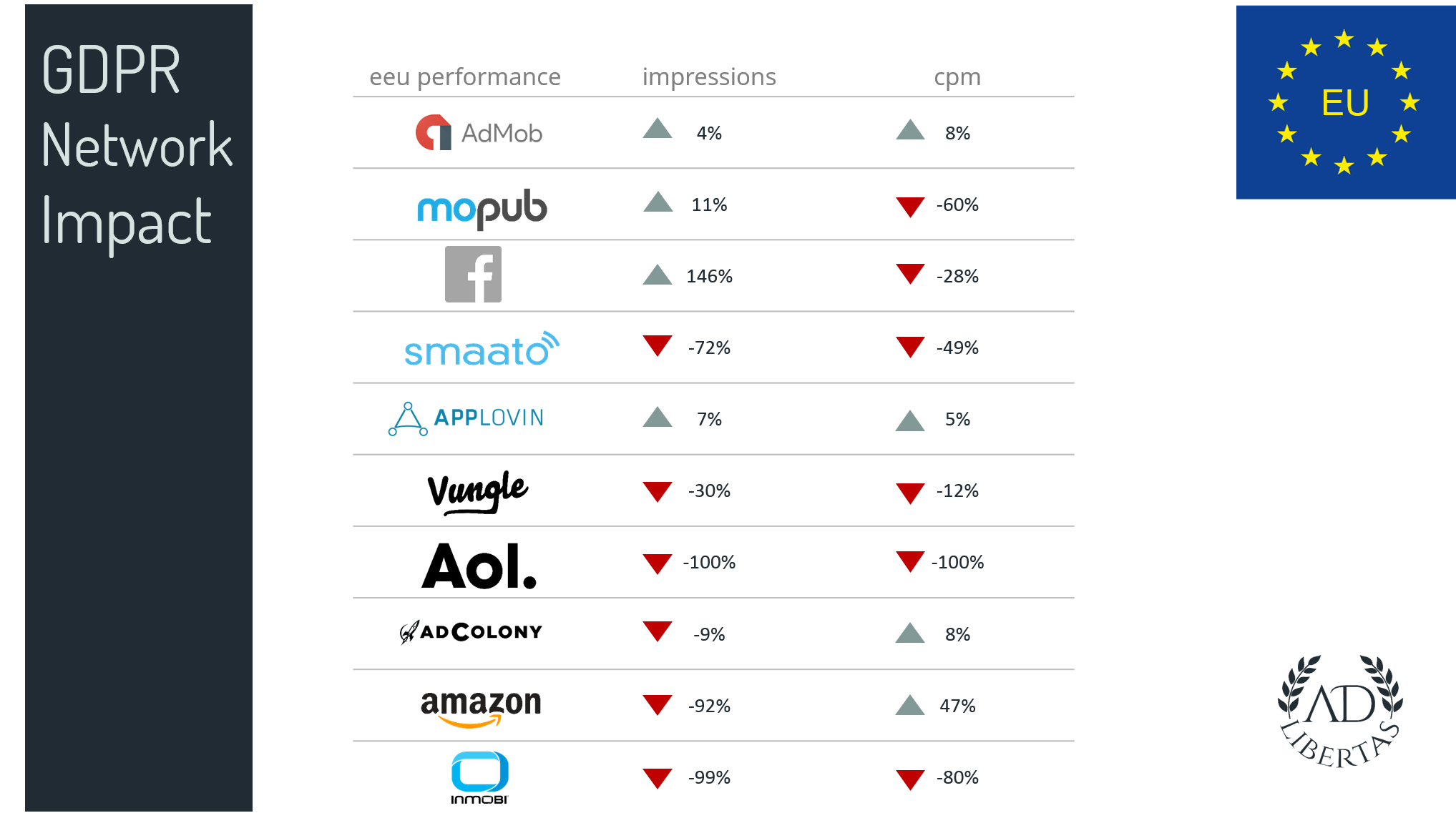

- Some networks have stopped buying completely in the EEU, others are scooping up remaining traffic at lower CPMs.

One constant with GDPR is the diversity in which compliance has been achieved. For mobile publishers, reactions have ranged from simple privacy policy update notifications, to indefinite suspension of services to the European Economic Union (EEU). Likewise the buyers have taken similar, widely disparate paths: some have levied complete suspension of buys, others sent notifications to publishers that essentially stated “it’s your problem.”

We’ve taken some early-level traffic impacts to help show the baseline of where & how the May 25th deadlines have affected worldwide mobile publisher ad traffic.

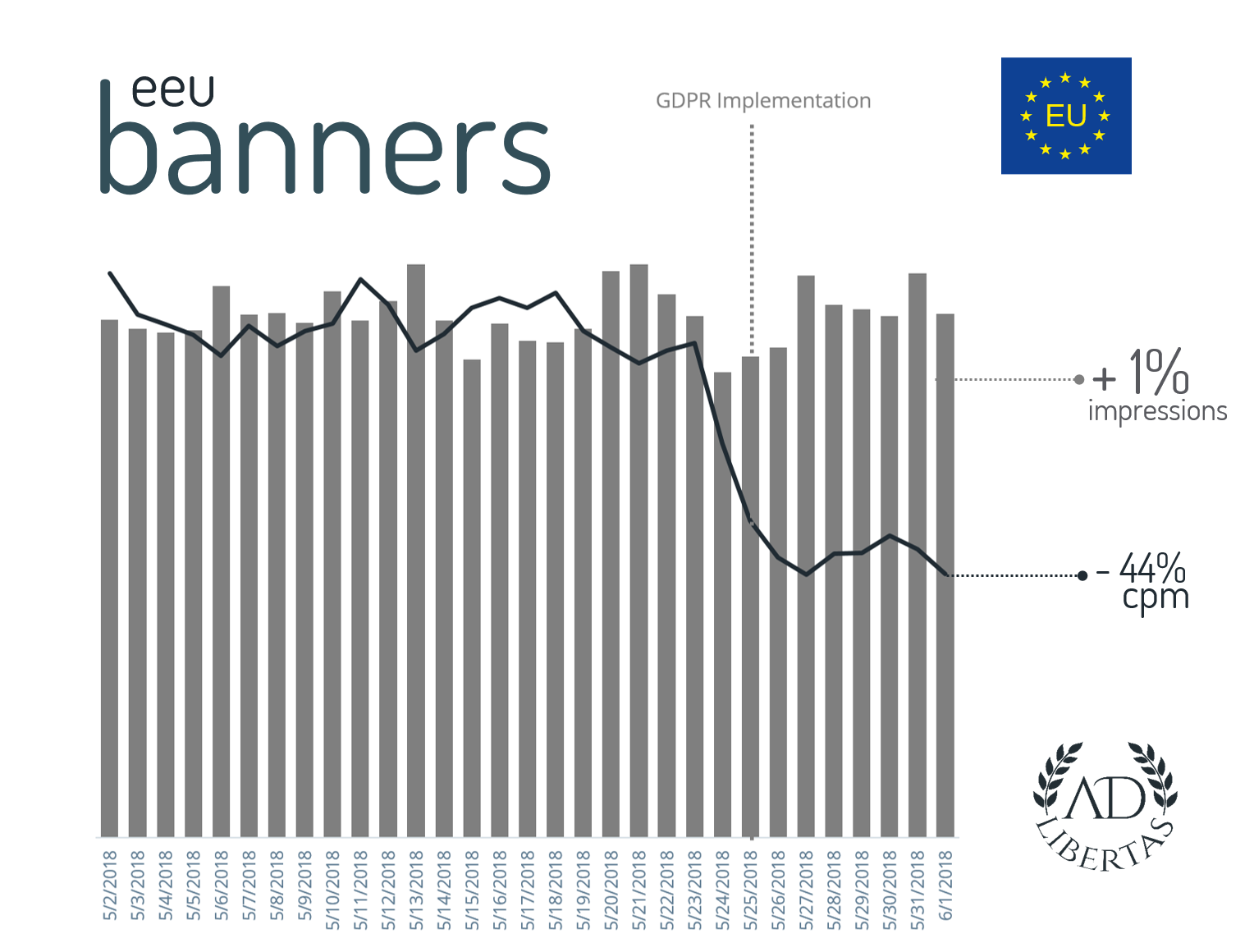

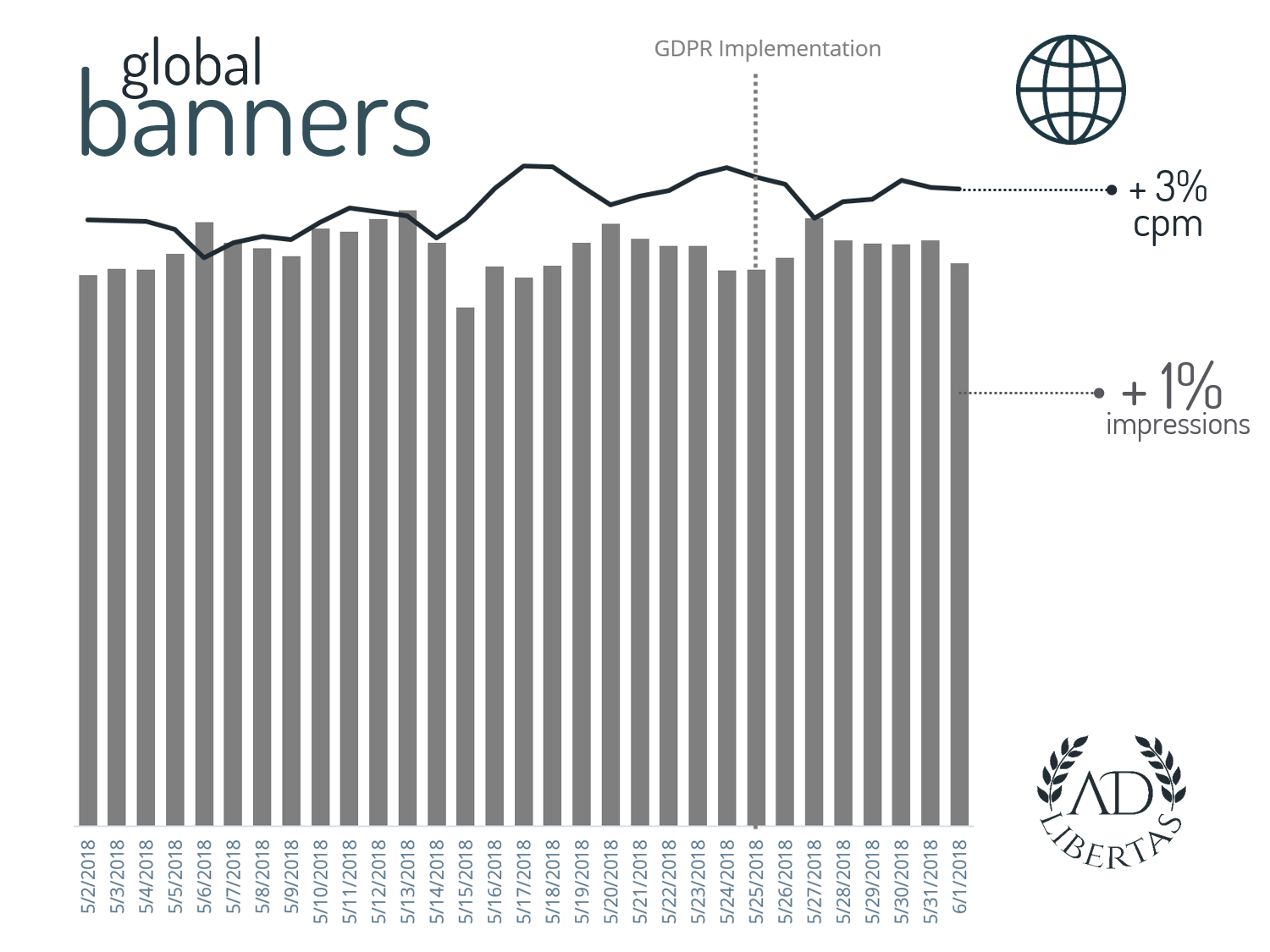

Banner Analysis

- Massive falling in prices across all all EEU regions likely due to advertisers not receiving targeting information (IP/Advertiser ID).

- Networks buying with tags impacted heavily.

- Volume static as lower-tiered campaigns soak up inventory glut.

- Despite massive EEU drops, global banner performance remains largely unaffected.

- Global growth flat, despite usual month-end spikes.

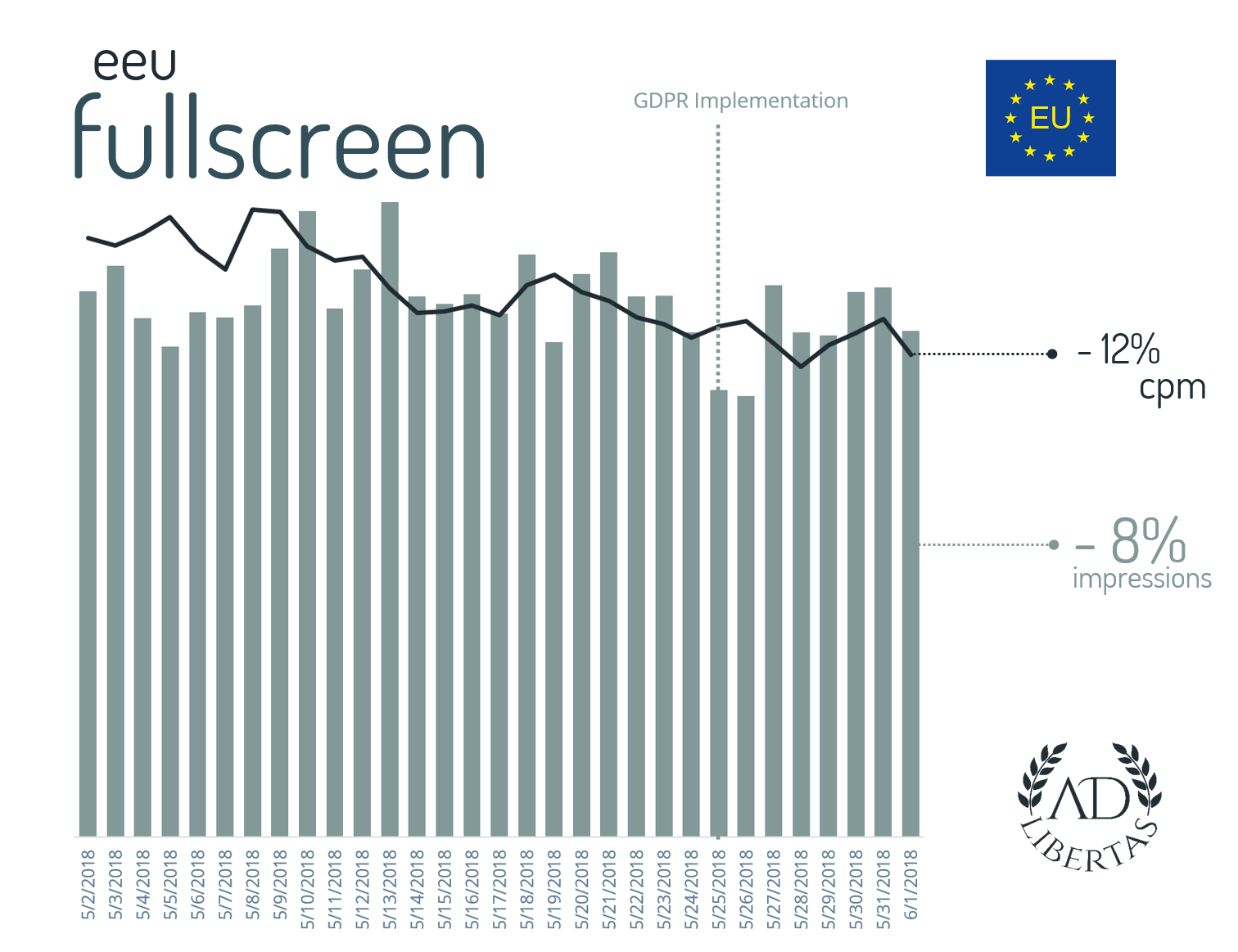

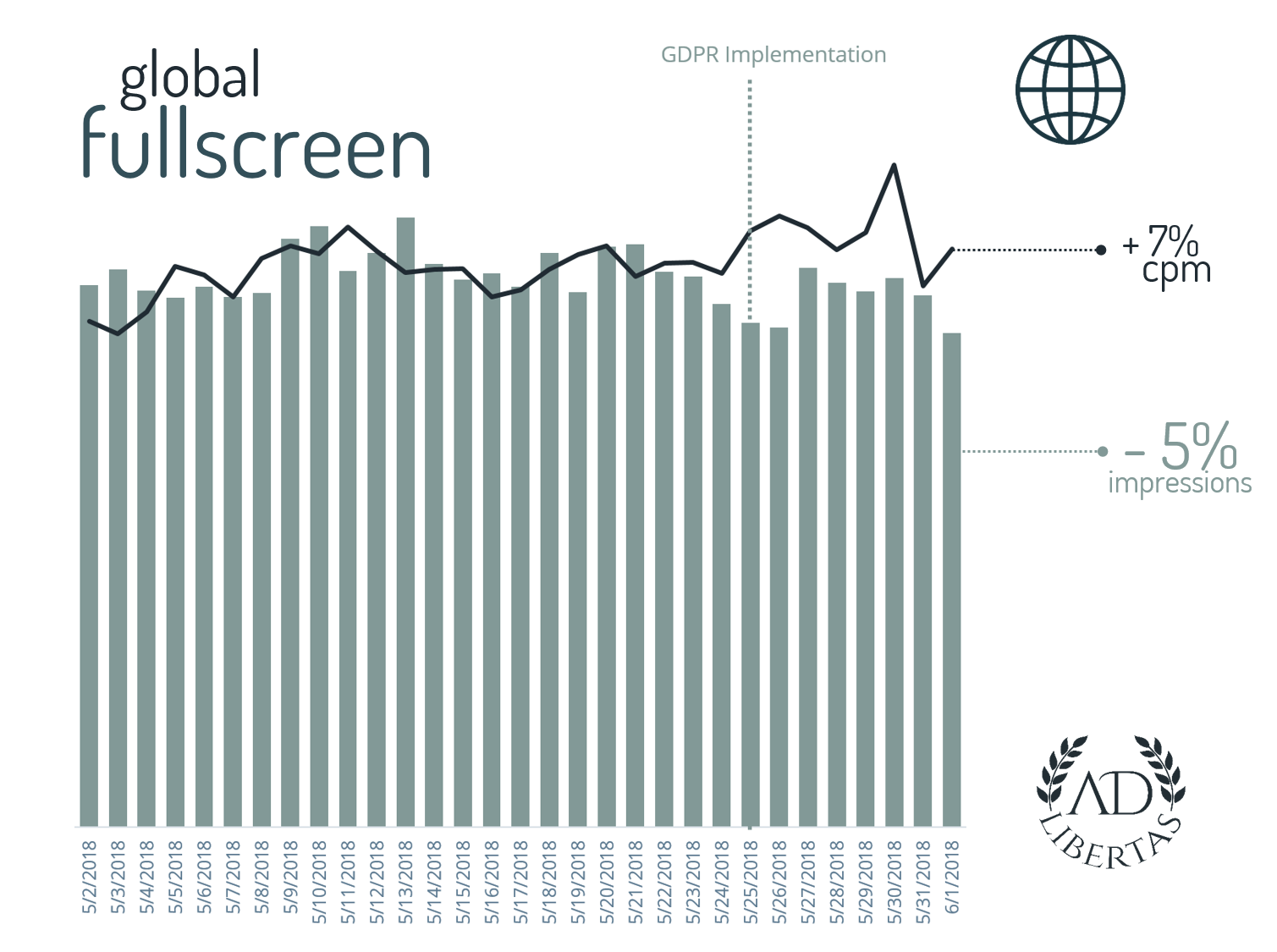

Fullscreen Analysis

- Fullscreen inventory much less affected as enabled buyers back-fill those with slowing demand.

- Fullscreen buyers have prevalence of SDKs, allowing them (when approved) to continue to target users.

- CPM down in EEU, likely GDPR impact, as opposed to usual month-end spike (as represented in global).

- Admob surprisingly up in CPM & volume. Not surprising as they are pushing all compliance onto publishers.

- MoPub: For inventory failing to obtain opt-ins IP & advertiser ID stripped. Traffic volumes increase & CPM lowers as MoPub demand scoops up banner inventory ignored by other buys. Demand is heavily impacted, unable to target properly.

- Facebook: With their unique reach to force user opt-in Facebook massively steps up volume to take competitor volume at a lower price. Facebook likely doing quite well. **Facebook API access challenges through the month of May also skewed traffic as many partners scaled back Facebook impact while reporting was unavailable.

- Smaato: Traditional tag-heavy European buyer predictably heavily impacted as all MoPub tags ceased buying traffic in the EEU.

- AppLovin: SDK-heavy network with early GDPR opt-in solutions for developers taking advantage of lowered competition.

- AOL: Tag-heavy giant in the EU wisely takes the safe approach by ceasing all traffic until publishers can manage compliant opt-ins.

- Amazon: in a last-minute notification to publishes, Amazon stopped buying in the EEU.

- Inmobi: Ceased buying traffic in the EU (Note: does not include Aerserv.)*

*Note: After publication InMobi contacted us to provide publisher guidance on their GDPR approach:

InMobi’s publisher partners are actively updating their own apps with new consent mechanisms and our updated SDK. We are currently measuring ~10% of pre-GDPR supply available with consent and expect over 15% next week. This figure is growing daily as more and more apps are getting updated on the appropriate app stores and users are providing consent. We expect to see approximately 50% by the end of the month as several large partners are testing their consent frameworks now (although that timeline is subject to their own development cycles.) – Thomas Blank, InMobi