Case Study: Do the actions of a user’s first day help predict long-term value?

Mike Newman, creator of Flow Free, always wondered if the number of games played on the first day would help predict a user’s lifetime value (LTV).

Background:

Mike Newman of Big Duck Games is the original creative mind behind the app store staple Flow Free®. The title’s runaway success has netted them over 300MM downloads so it’s safe to say the title has enjoyed success as it closes in on its 10-year anniversary. The app is monetized via advertising through MoPub and in-app purchases on both iOS and Android platforms. Analytics and A/B testing is handled by Google Firebase and some in-house technology.

The Problem:

A question that’s always intrigued Mike: how much does a user’s early-level behavior influence long-term retention and performance?

“Intuitively it makes sense that a user who plays more games on the first day would indicate a potentially valuable user.

But do they stick around for longer? Do advertisers end-up paying more for this user day-in and day-out? How does this relate to value a year from now?

While I can guess, there hasn’t been an easy way to us to measure this.”

The Solution:

Enter AdLibertas Audience Reporting. By connecting MoPub Impression-Level Reporting, Firebase analytics and IAP events Mike is able to get a clear, accurate view to revenue performance by user behavior.

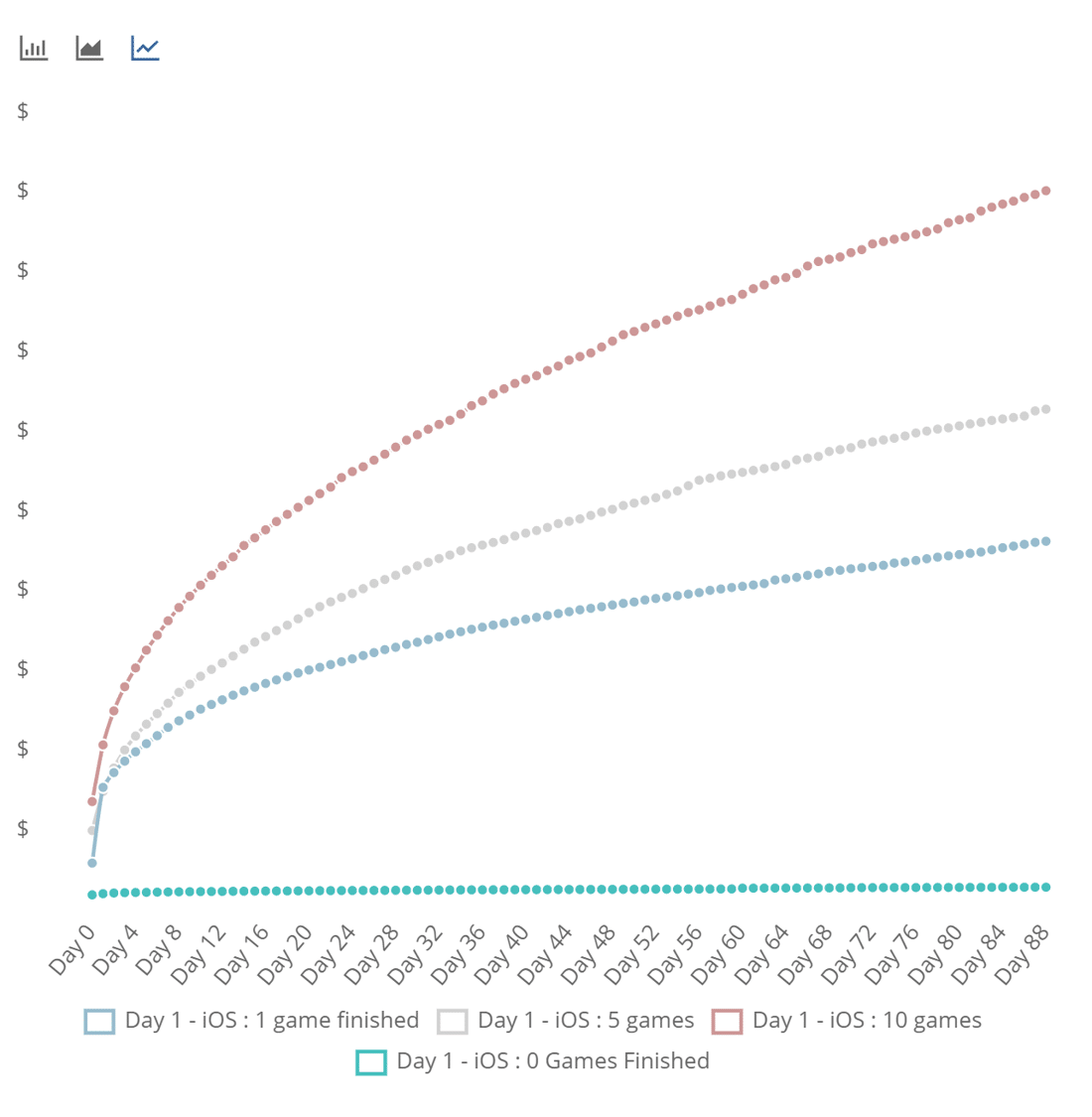

Mike used Audience Reporting to break apart users into 4 categories to understand early user behavior:

1. Red – Users who’ve completed 10 games on day 1

2. Grey – Users who’ve completed 5 games on day 1

3. Blue – Users who’ve completed 1 games on day 1

4. Green – Users who’ve completed 0 games on day 1

Actual LTV curves earned by users via ad & in-app purchases segmented by the number of games played.

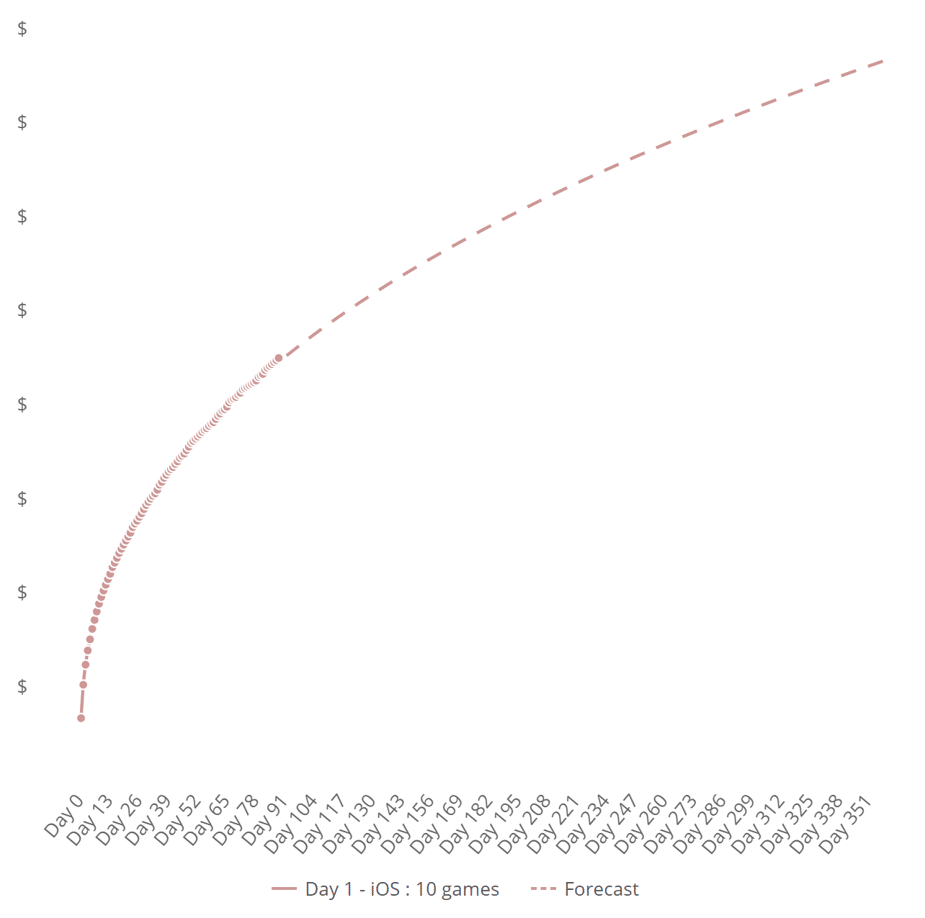

Predicted 1-year LTV of users who’ve played 10-games on day 1 (linear regressive log transform, excluding d1-7)

Takeaways:

While the results make sense, the overall learnings are very interesting:

1. Users who play 0 games on day 1 often churn quickly and within a year don’t match LTV earned by 1-game completers on their first day.

2. While 1-game players and 5-game players show similar daily revenue, but 5-game players have much better retention showing higher lifetime values.

3. 10-game completions are ~2X more valuable than users who only complete 1.

From a product development perspective, it’s clear we have an opportunity to turn a 0-level player into a 1+ level player – with corresponding LTVs – if we can shift the player’s early behavior through better onboarding.

It’s pretty clear that if a user doesn’t play a game, they aren’t going to end-up sticking around or ever be valuable.

Audience Maturity Progress:

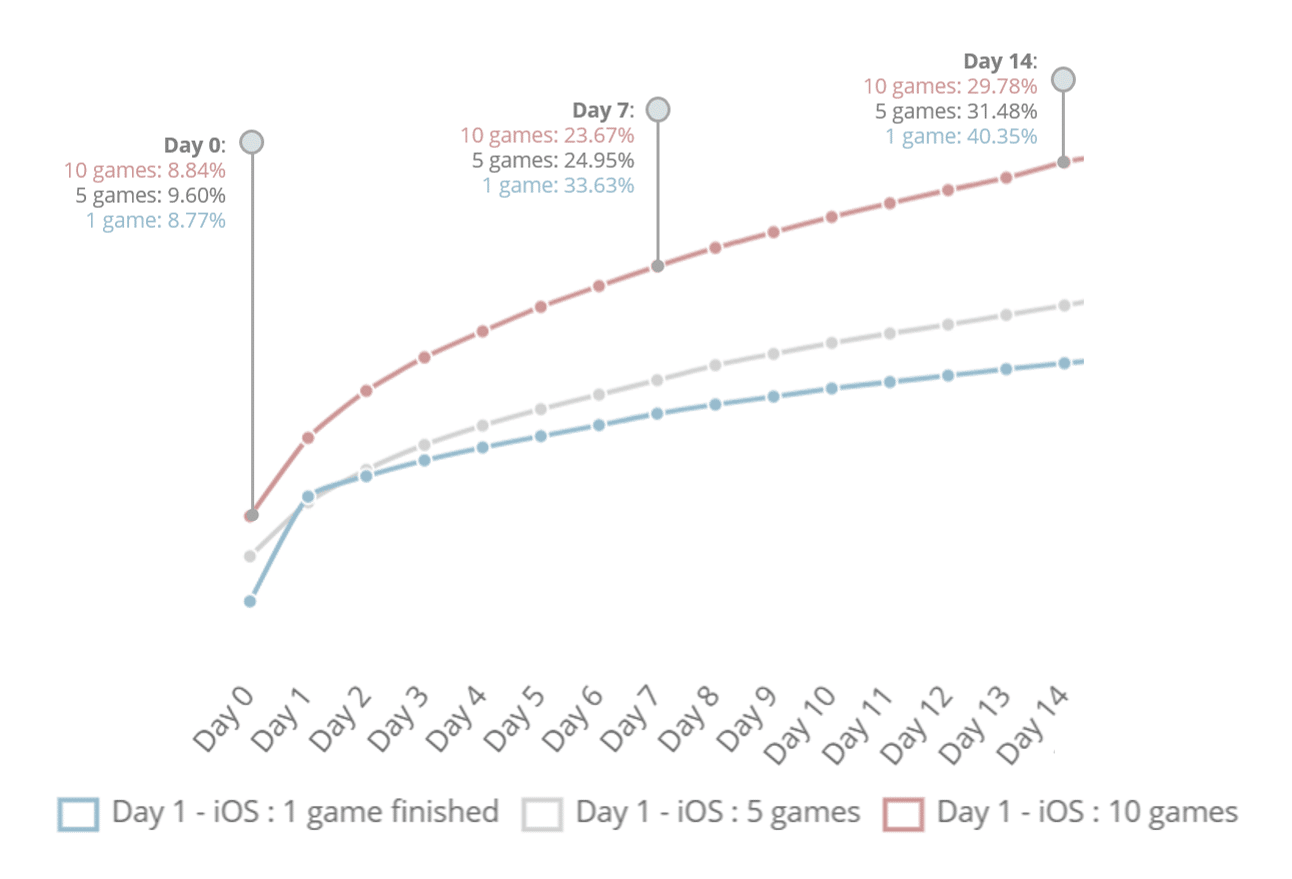

D1-14 LTV curves of 3 player cohorts and their corresponding 1-year pLTV maturity.

| Day | 1 games (% maturity d365) | 5 games (% maturity d365) | 10 games (% maturity d365) |

| d0 | 8.77% | 9.60% | 8.84% |

| d7 | 33.63% | 24.95% | 23.67% |

| d14 | 40.35% | 31.48% | 29.78% |

| LTV (Index) | LTV (Index) | LTV (Index) | |

| d365 | 0.62X | 0.95X | 1.41X |

Maturity Observations:

1. Users for all three audiences reach a uniform ~9% of 1-year maturity by day 0

2. Higher value users reach maturity slower, driven by higher retention curves.

3. Retention curves strongly differ between audiences. ARPAU does NOT give accurate LTV predictions.

For user acquisition, these findings are especially useful for setting conversion values quickly. On day 1 we now have indication of future user value and we can target campaigns appropriately.

Before we were just guessing at this value. Now we can target these higher value users more efficiently.

Interested in how predictive forecasting could work for ? See a demo above or read about how the product works below.