iOS 14.5 CPMs: Too soon to call?

iOS CPMs are showing indications of a major impact – or is it simply severe month-end fluctuations?

The day of reckoning is upon us – iOS 14.5 was released on the afternoon of April 26th. Publishers have been worried about the revenue impact that the changes might bring to their iOS apps, and have been closely monitoring key metrics such as iOS 14.5 adoption rate, opt-in rate and CPMs. Flurry has been actively tracking the adoption rate and opt-in rates across its networks (today at 11% opt-in), providing valuable insights into how consumers are responding to the initial release of these features.

We’ve been closely monitoring CPMs, keenly aware that they will be impacted not only by the iOS 14.5 adoption rate and opt-in rate, but also the ebbs and flows of advertising budgets and prices, which tend to fluctuate at the end of every month and quarter. This makes sense, as a lot of advertising, especially brand advertising, are tied to strict budgets. A helpful comparison in this case is doing a side-by-side with Android CPMs to better understand which fluctuates may be budget-driven and if iOS 14.5 is having an impact.

Today was the first day we’ve seen any CPM stability since a drop-off at the end of the month. Below are the year to-date CPMs charted by day against an indexed average.

Is this an indication of a new normal? Or the beginning of a price-reset similar to a January 1 adjustment?

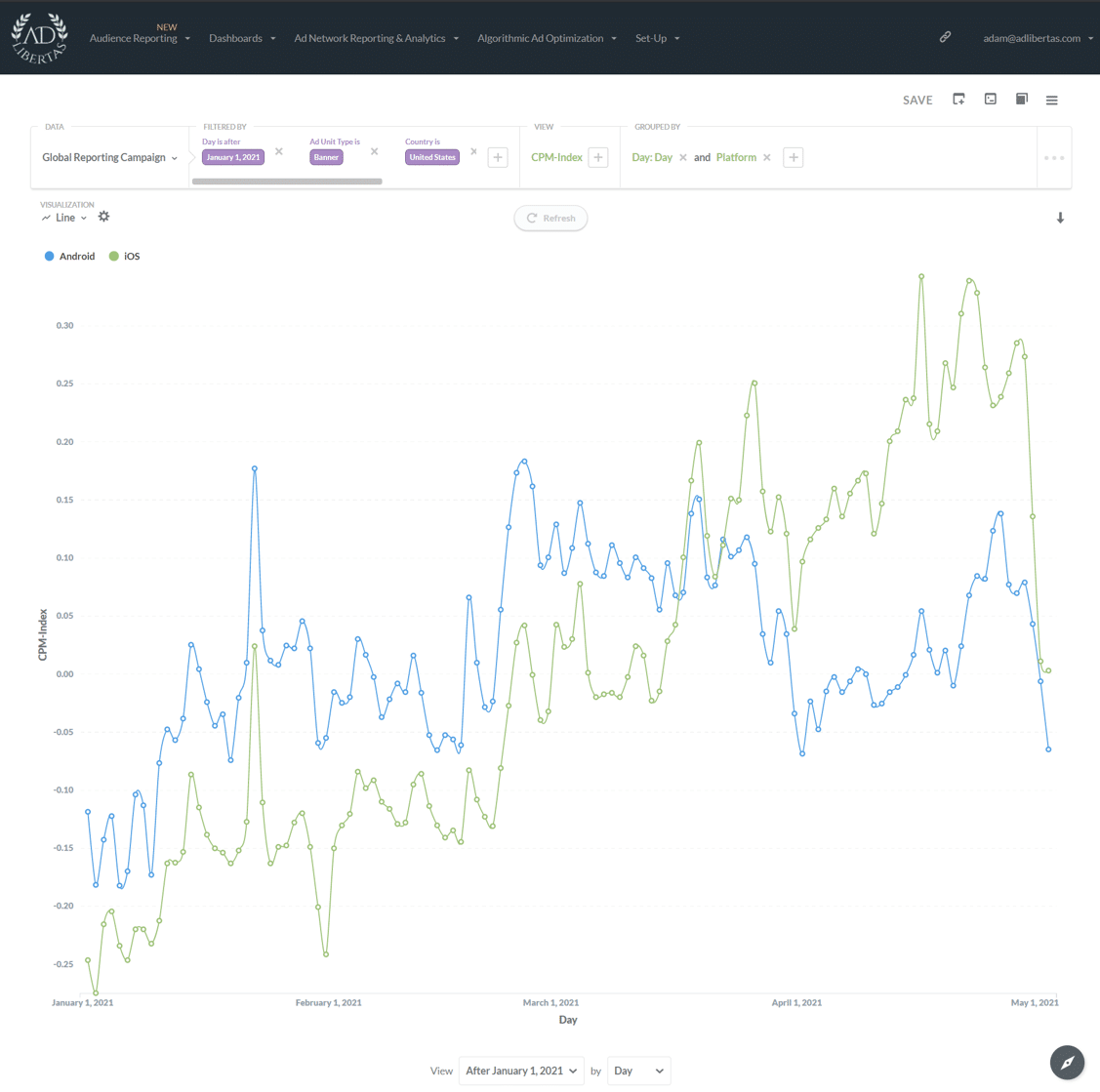

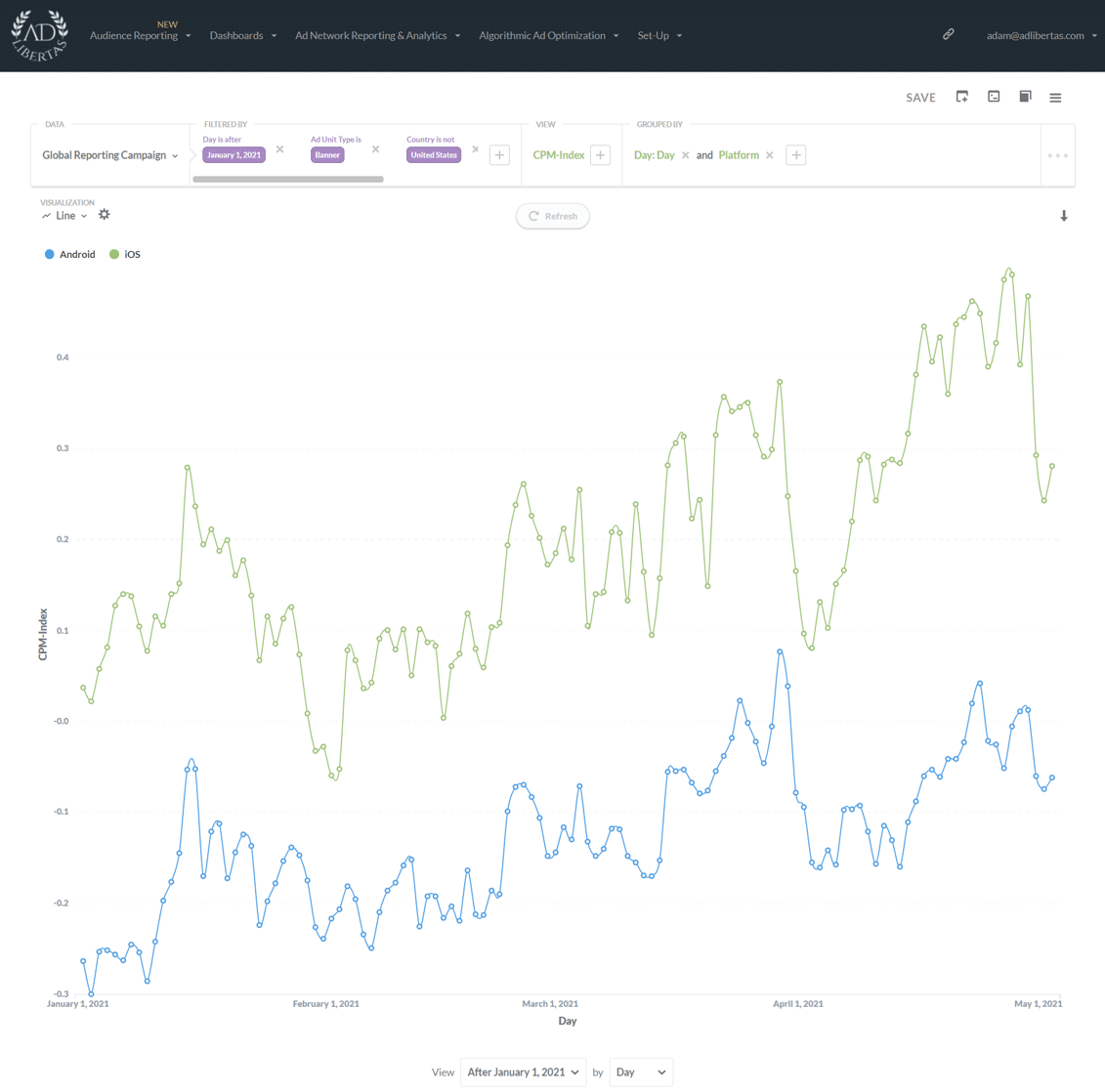

Banners:

Banner CPMs for both US and non-US traffic appear to be relatively flat day over day until April 30th, then showing a steep downward trend starting May 1st for both Android and iOS. However the downward indexed movement of Android is similar in scale to months past while iOS (specifically US) shows a much higher rate of drop, suggesting some CPM impact on banners are driven by monthly budget fluctuations but lend credence to an increased impact by the iOS 14.5 rollout.

Edit: Curiously, the low-adoption rate here would be representing a higher-than-expected CPM impact posing the question: perhaps buyers are changing behavior ahead of actually seeing ATT-enabled users?

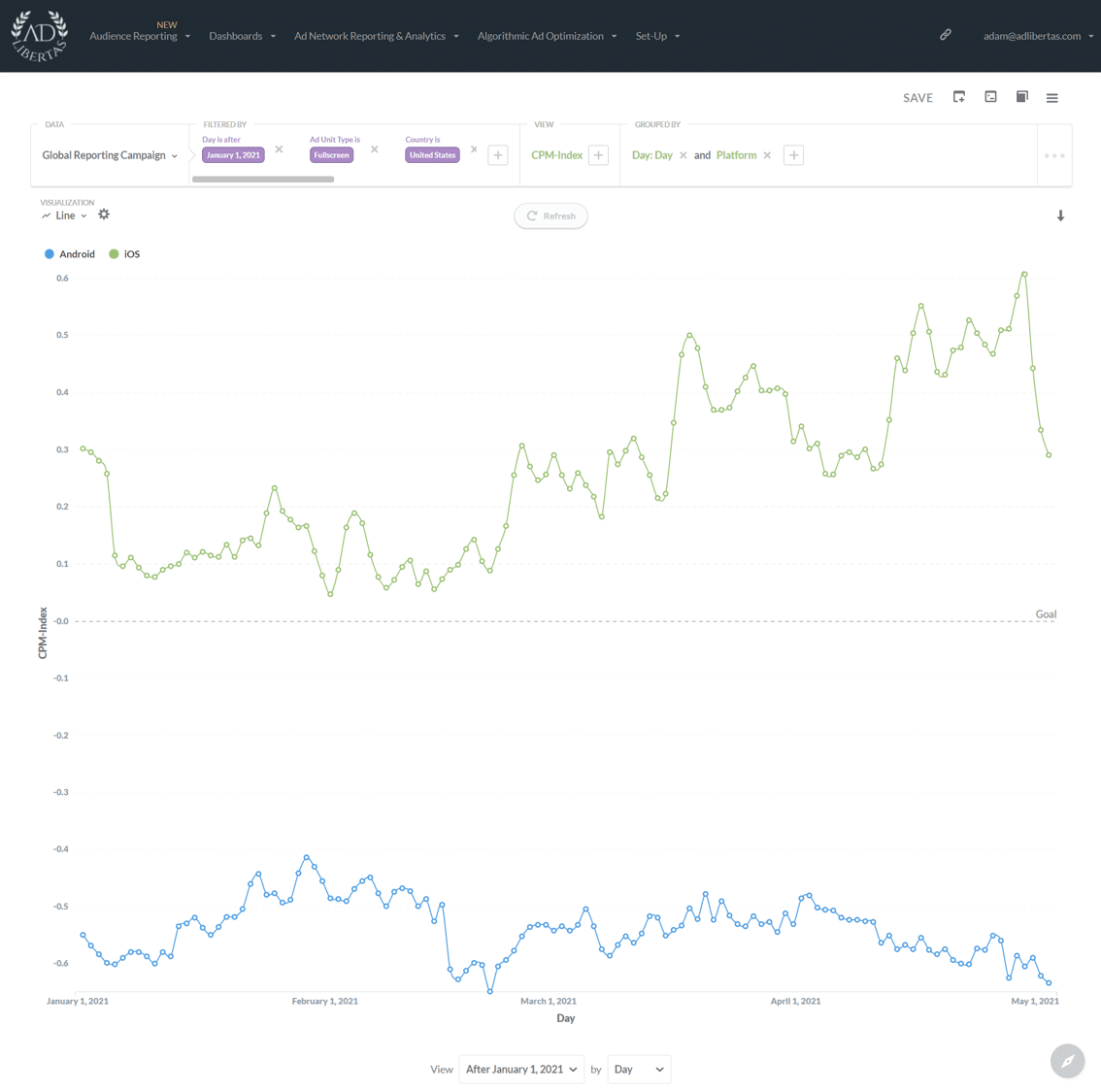

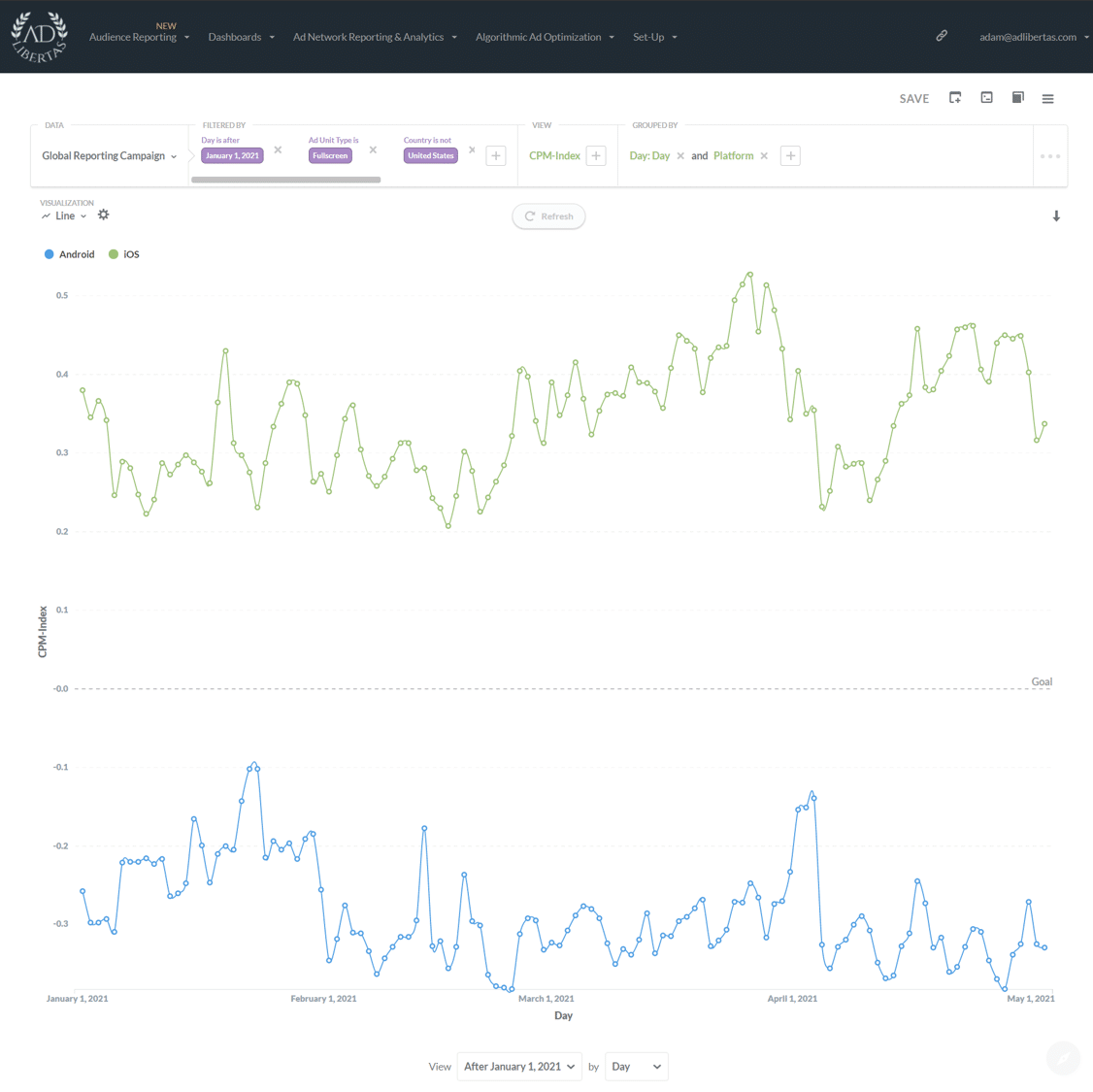

Fullscreens:

Fullscreen CPMs for both US and non-US traffic also appear to ebb relatively flat day over day until April 30th, then have a downward trend starting May 1st for both iOS and Android. And while Android has been impacted less it’s too early to tell if this is indicative of a pullback of spend to favor Android, or more-than-usual monthly fluctuations.

Note: the index is wide because of the disparity of CPMs between each platform.

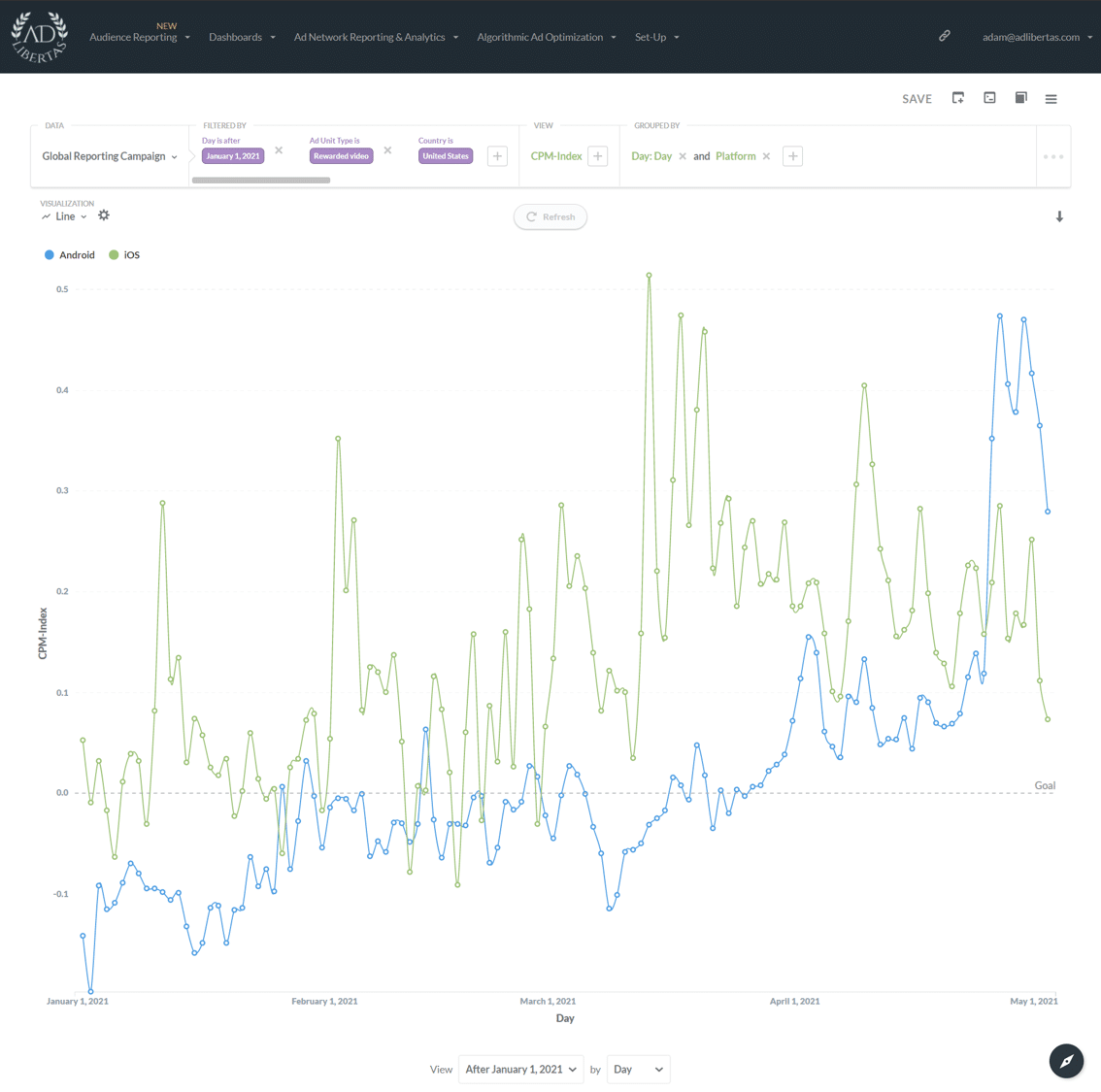

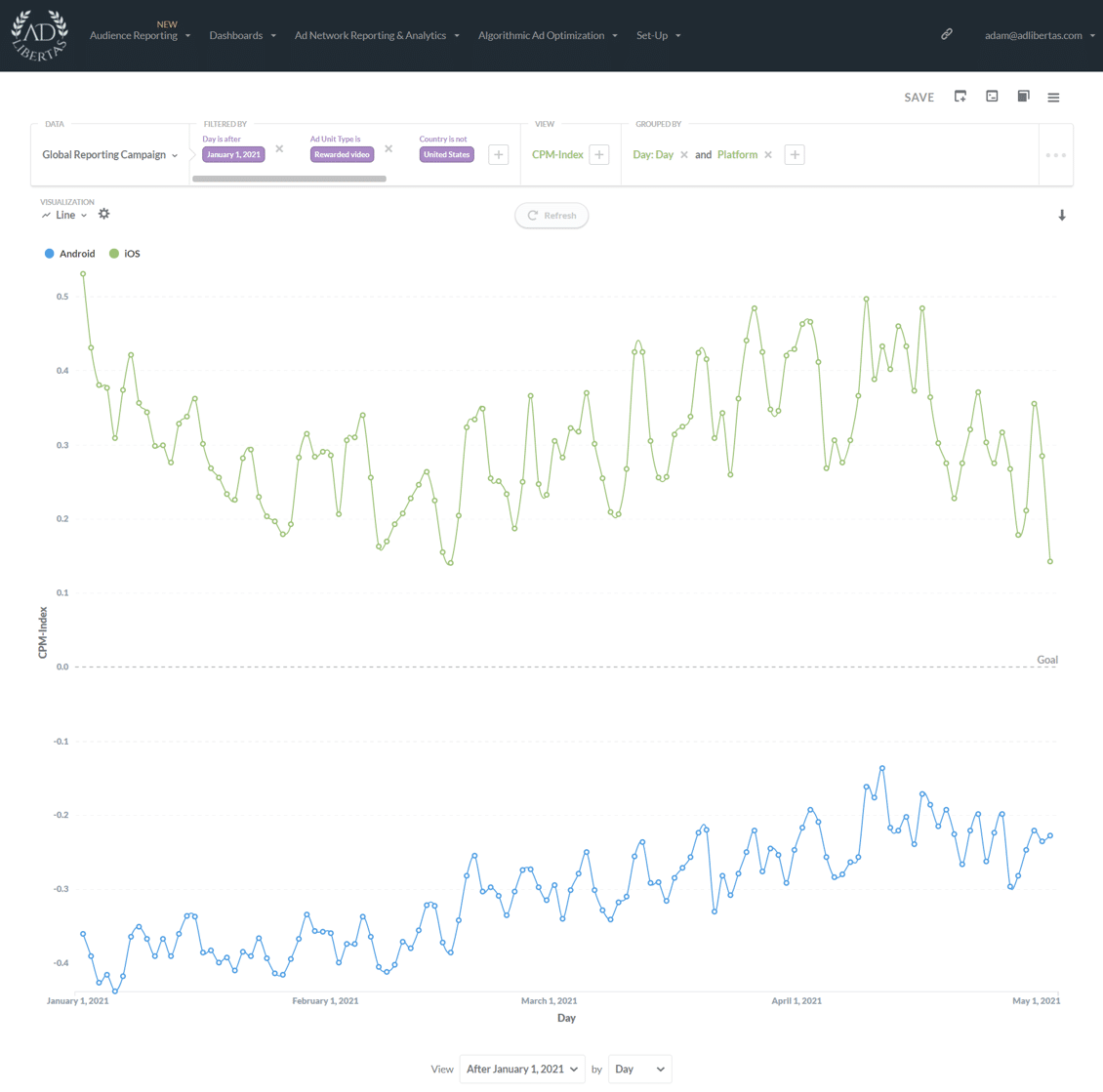

Reward Video:

CPMs on Android US traffic spiked when iOS 14.5 rolled out, and have remained elevated compared to iOS US CPMs. Outside of the US, CPMs have taken a dip on iOS, while Android has remained stable. Rewarded Video traffic is almost entirely performance, suggesting either budgets or performance is higher on Android. We will have to keep an eye on this to see if it’s a short-term blip or indicative of a longer-term trend.

Note: the US index volatility stems from the tight averages between the platforms.

Takeaways:

While it’s still early, the initial data suggests that the iOS impact is hurting banners immediately while the more performance-orientated ad units (full screen & reward video) are slower to show impact. While brand buys are more impacted at quarter and year-end, perhaps the changes to buying will impact hit brand buyers while the performance advertisers continue to hold-out for as long as possible?

Time will tell if the performance advertisers are affected as much as the roll-out continues. We intend to periodically update this post over time as more data is available.

About Us:

AdLibertas makes tools to help app developers earn more from their apps. If you’re interested in seeing something specific — such as the affects to demand sources — please do let us know at info@adlibertas.com.