Q3 Market Watch: CPM adjustment & analysis

Q3 Market Watch: CPM adjustment & analysis

Executive summary:

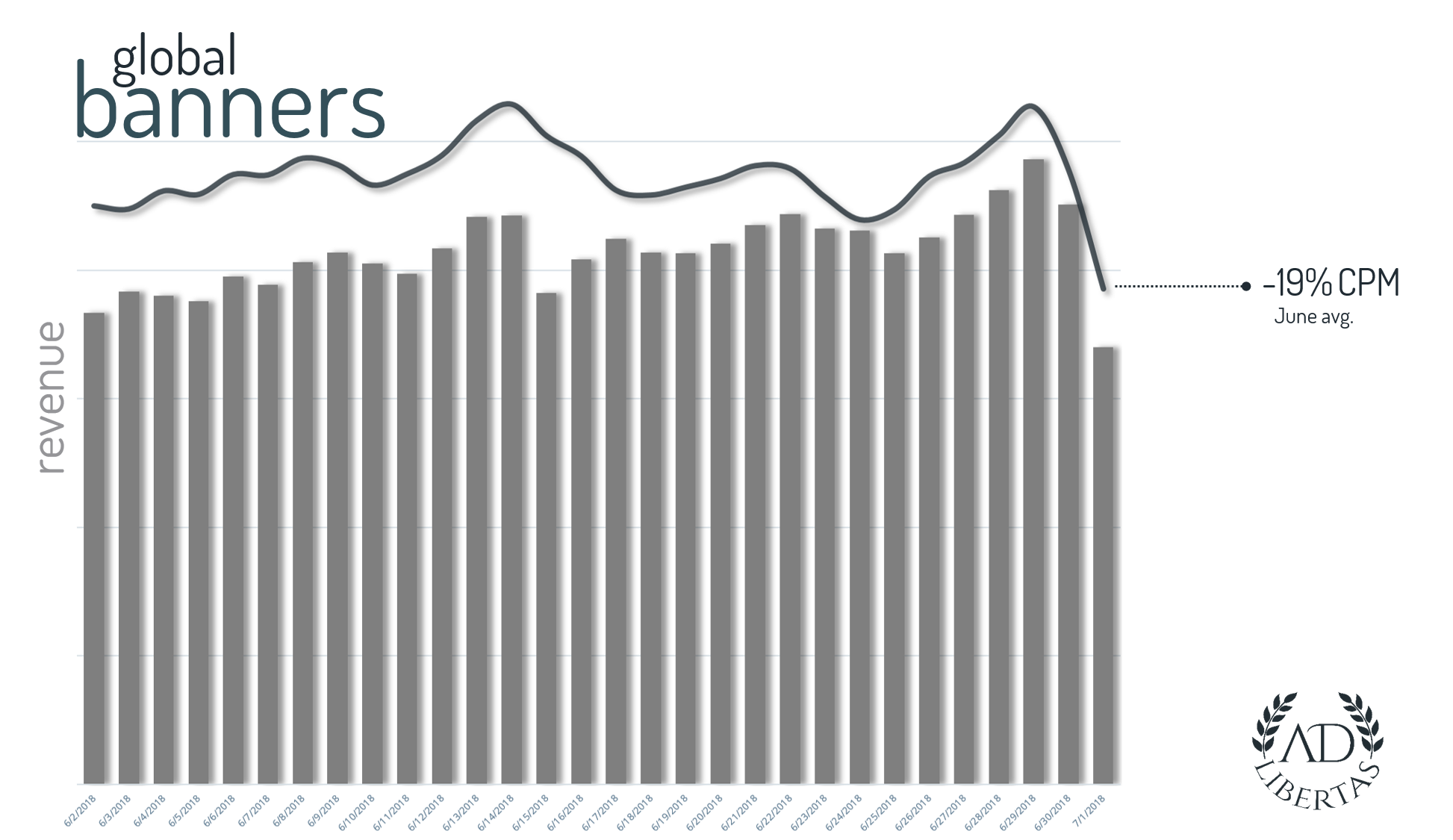

- Banners: mostly driven by traditional brand cyclical budgets—are most impacted, dropping 19% from end of quarter highs (+11% avg).

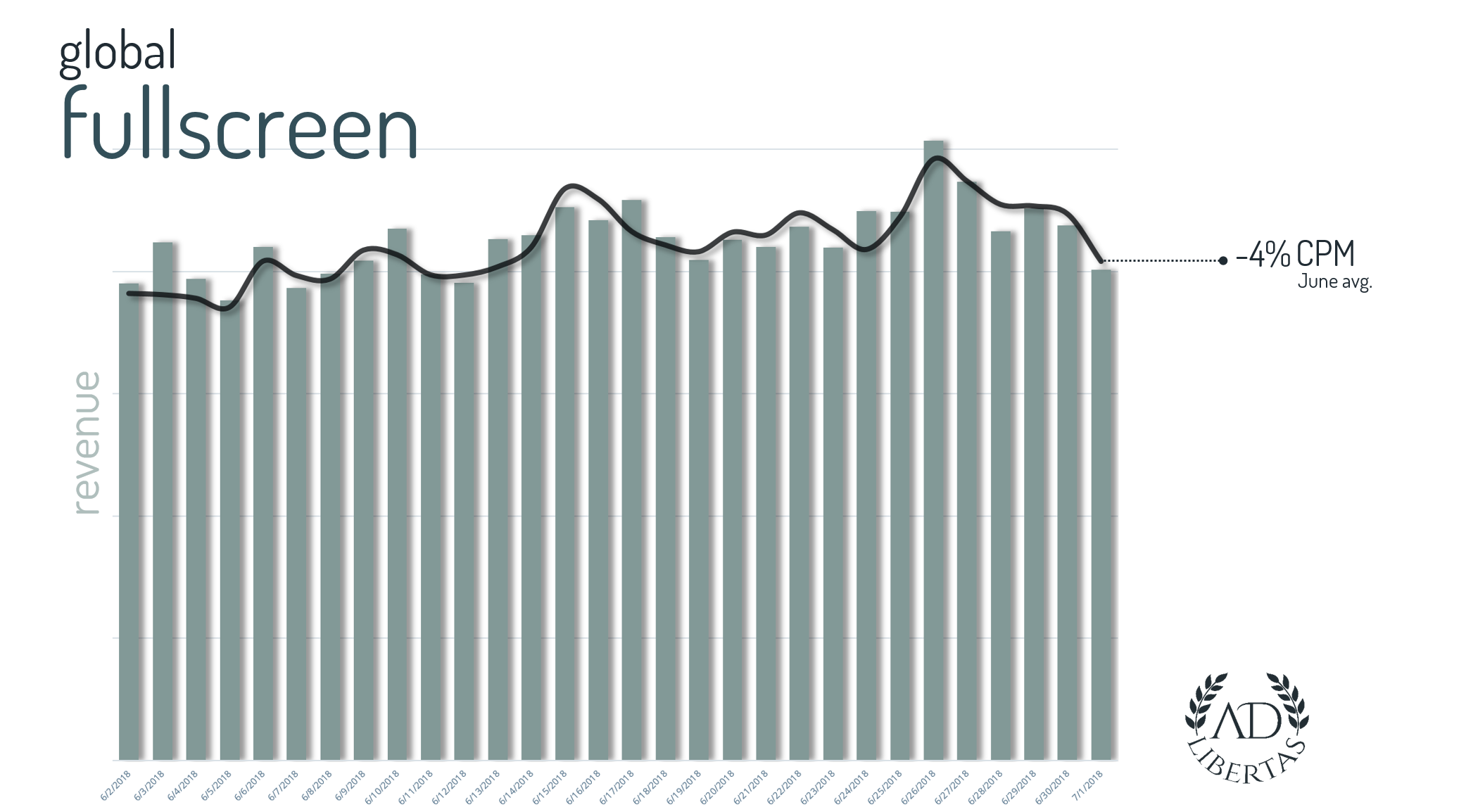

- Full Screen: Largely performance (more often fixed) are impacted less (-4%); some partners buying increased.

- Global FullScreen CPM sitting at 12X banner.

Actions to take:

When CPMs fall, you’re not powerless. Much like trading in financial markets a down economy requires actions to maximize yield:

- Cut out under-performing top end floors: High demand can create (temporary) shifts in prices for buyers increasing CPMs to reach inventory level goals. As these budgets stop some of your higher prices floored may start to dwindle in performance – causing latency that will impact the waterfall negatively. Watch for falling fill rates – and a very important metric: percentage of revenue contributed to determine the floors no longer adding value to your inventory.

- Introduce lower floors: Likewise as prices adjust, there is opportunity to make up some lost revenue at the lower-end of your waterfall. We introduce mid-price floors, looking for gaps in the demand-price curves. You’ll want to ensure you monitor these lower floors so they don’t cannibalize pricing at your higher ranked pricing structure.

- Take advantage of shifts in demand: performance buyers – who regularly buy on budgets that vary less during quarter shift will often take advantage of lowered competition and increase their buying as they find gluts of inventory. Today Vungle is up 35%, TapJoy up 19%, AdColony up 13% from end of quarter.