Top Network Performance – 2018

Top Network Performance – 2018

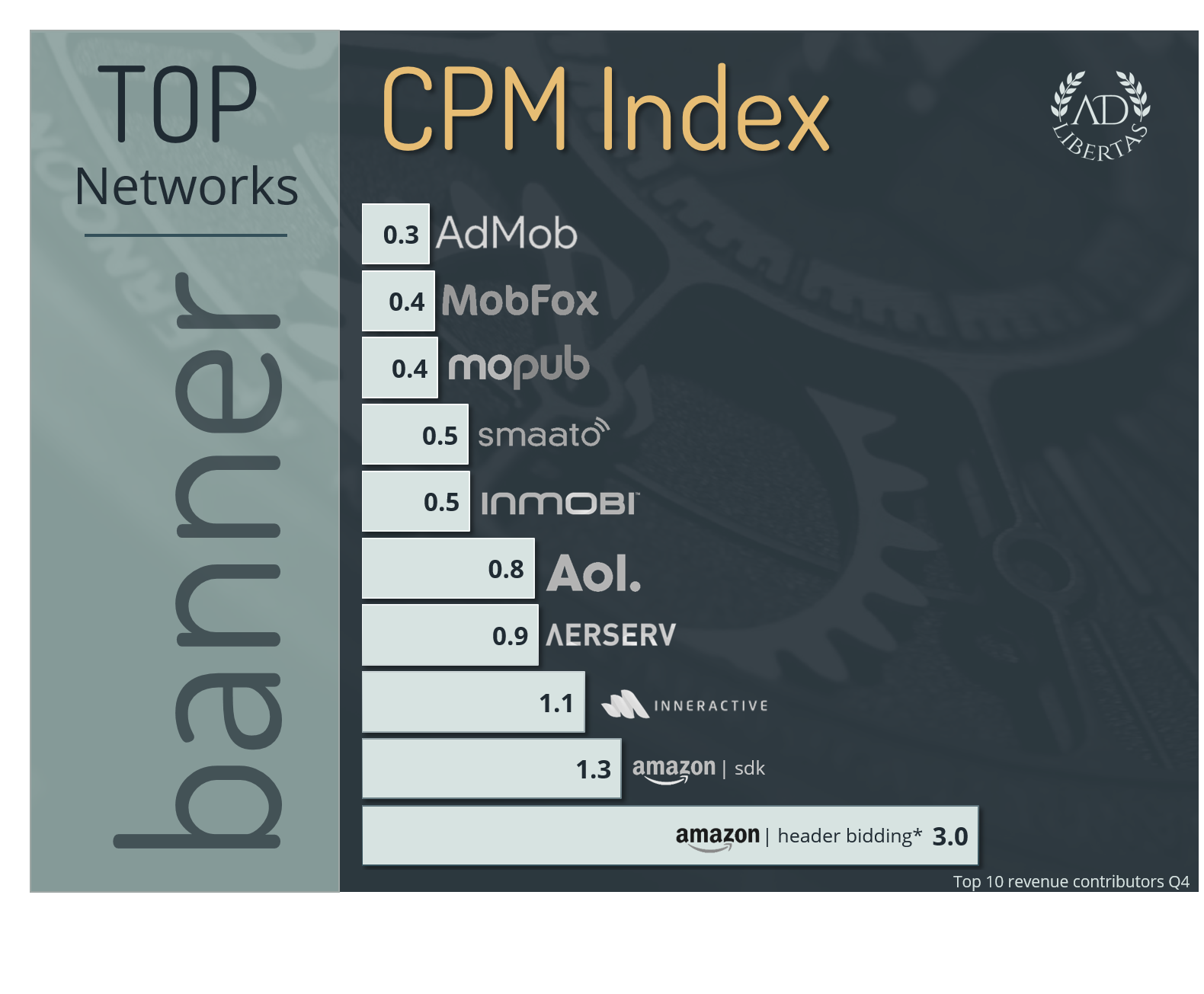

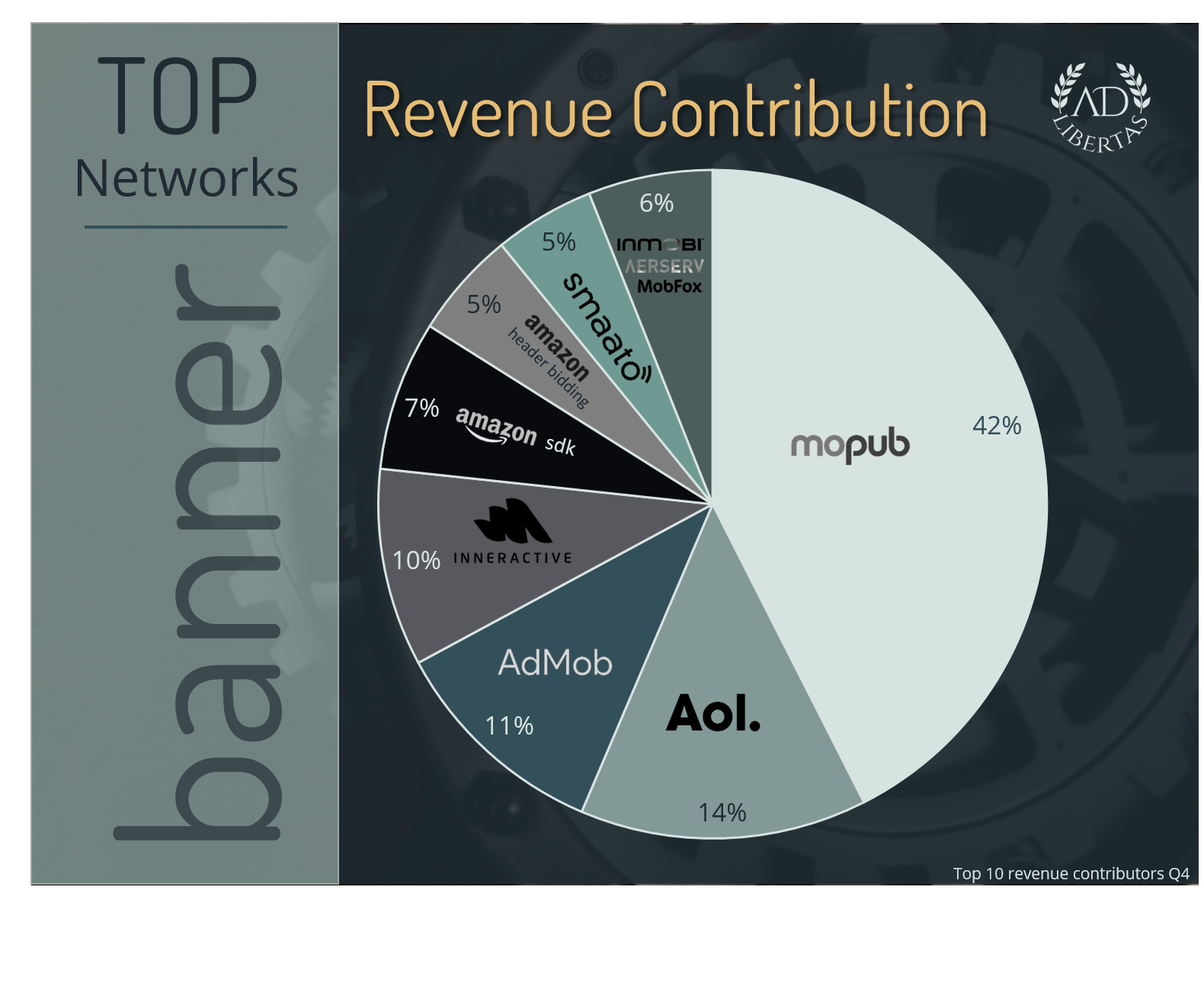

Banners:

- Amazon takes the top 2 CPM placements but there are two noteworthy comments to consider:

- Amazon is well-known for only operating in select countries, (following their business model and as a result they skew higher given the majority of these countries inherently have higher demand.

- We have seen high serving discrepancies among partners serving Amazon Header Bidding. Our numbers here are as the network reports and may not be accurate when unified against ad-server counts.

- MoPub has started to dominate sheer volume of impressions, generating 42% of total revenue despite being at the bottom of the top producers for CPM. This shouldn’t serve to indicate MoPub can’t play with higher CPM, they do but the long tail of volume definitely skews world-wide results.

- Admob’s focus has backed off banners and their results have fallen since our last report. Also of note is Admob’s new 3-request ad policy, which caused most publishers to cease using Admob as backfill, the result is lower volume – but interestingly a lower CPM ranking too.

- AOL/Nexage/Millennial had a rough quarter combining the Millennial & Nexage SDKs and underwent yet another brand name change (Oath). However, they still managed to bring in an interesting amount of revenue at interesting CPMs. This, combined with their ability to run tags, makes them a solid choice for developers looking to soak up English-speaking inventory at a mid-range CPMs.

Notes:

- Our definition of banner is MoPub’s ad-type “banner.”

- CPM are indexed against the global market average.

- Numbers are based on network-reporting: serving discrepancies are not factored.

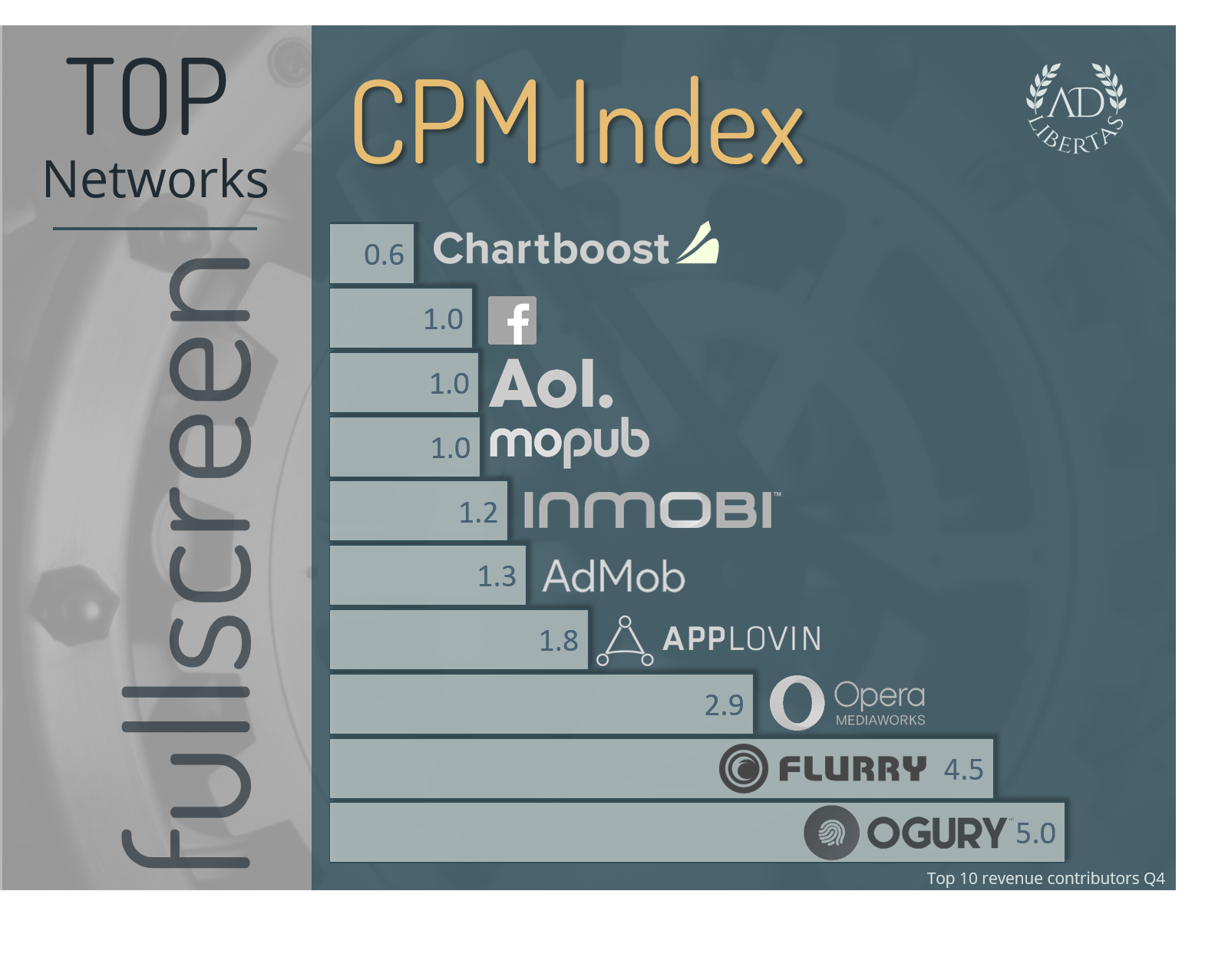

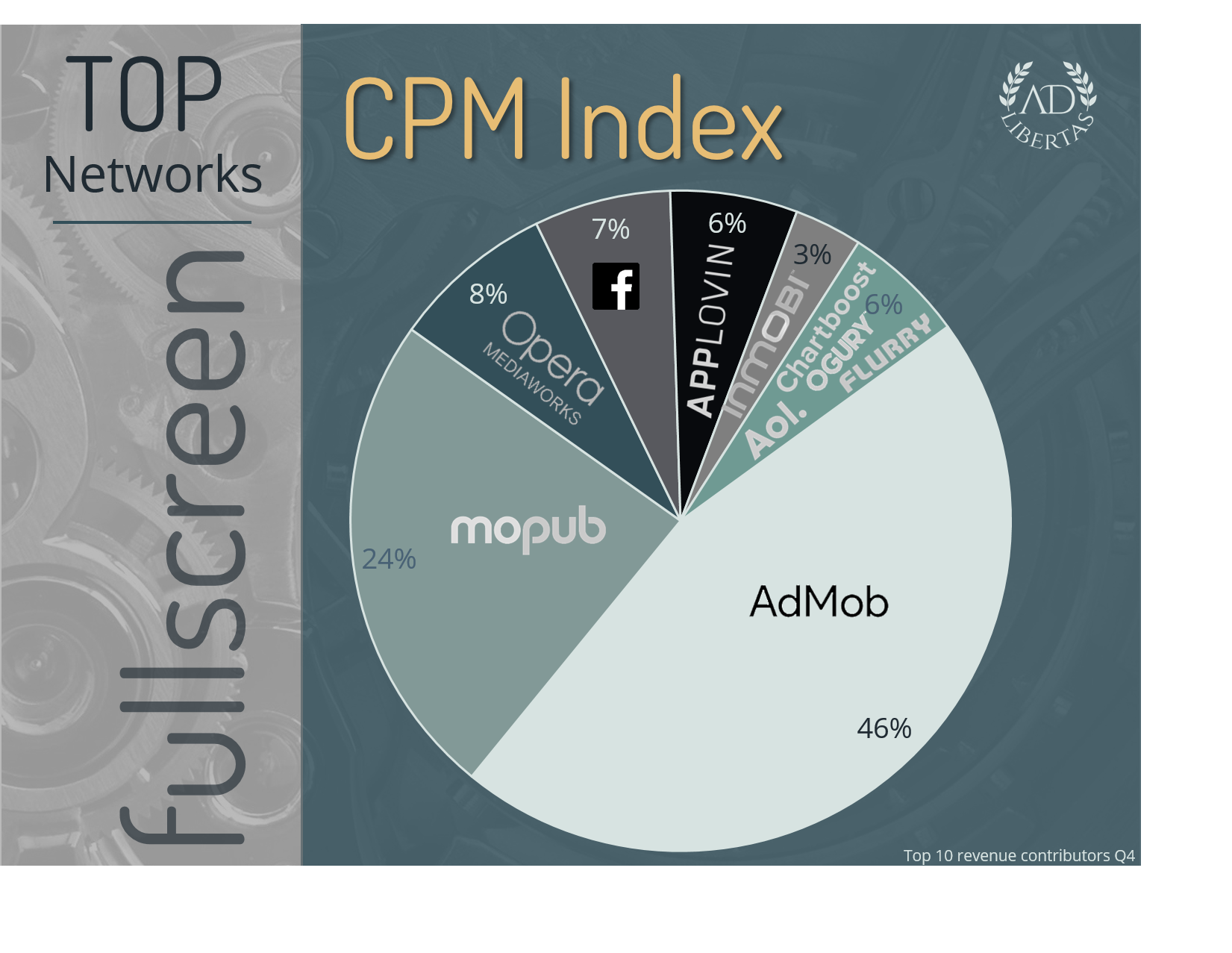

Interstitials:

- Admob holds steady at a massive half the revenue generated on world-wide revenue with a solid CPM. Combined with their global coverage, Admob remains a must for any developer’s integration.

- Second only to Admob, MoPub makes the market a duopoly, solid revenue and massive volume keep it in a commanding market position.

- Opera (AdColony) has undergone some massive upheavals in Q4 and has discontinued some of their bigger volume generating business units. It will be interesting to see how they fare in Q1.

- Although holding steady from Q2, Facebook’s recent addition of allowing price floors (they call them CPM Targets ) as well as their claimed renewed focus on Interstitials makes them a serious consideration for publishers wanting to round-out their interstitial inventory in Q1.

- Flurry – a blast from the past—surprised us by showing up in this list, their Q4 spending was sporadic but exhilarating. Their video inventory would regularly hit direct-level campaign CPMs, but would fill at very low fill rates.

- The relative newcomer Ogury has surprised us with a clear top-place CPM. They do have some restrictions (only certain countries, mandatory SDK, Android-only, and oddest of all: mandatory, Ogury-branded user-opt-ins) but for the undaunted developer, an interesting option.

Notes:

- Our definition of interstitial is MoPub’s ad-type “interstitial” this can include static, dynamic or even video served in this ad-type.

- CPM are indexed against the global market average.

- Numbers are based on network-reporting: serving discrepancies are not factored.